Describe Break Even Chart With Its Limitation and Specific Uses

Meaning of Break Even Charts. But while deciding upon the volume at which the firm would operate apart from the demand the management should consider the safety margin associated with the proposed volume.

Tutor2u Operations Introduction To Break Even Analysis

5 Deciding the optimum product-mix.

. In the break-even analysis since we keep the function constant we project the future with the help of. 3 Calculation of selling price per unit for a particular break-even point. In practice it will not be so.

Meaning of Break Even Charts 2. Variable costs do not always stay the same. The break even analysis is very useful in the area of managerial decision-making.

Multi-Product of Break-Even Chart. When break-even analysis is based on accounting data it may suffer from various limitations such as negligence towards imputed costs arbitrary depreciation estimates and inappropriate allocation of overhead costs. The break-even chart can help the management to know at a glance the profits generated at the various levels of sales.

Uses of Break-Even Analysis. However it has its limitations. Uses of Break-even Analysis 1 Calculation of profit for different sales volumes.

Limitations of breakeven analysis. Plant Shut Down Decisions 9. Make or Buy Decision 7.

A significant disadvantage of break-even analysis is considering the same price assumption for calculation purposes. 2 Make or buy decision. 2 Calculation of sales volume to produce desired profit.

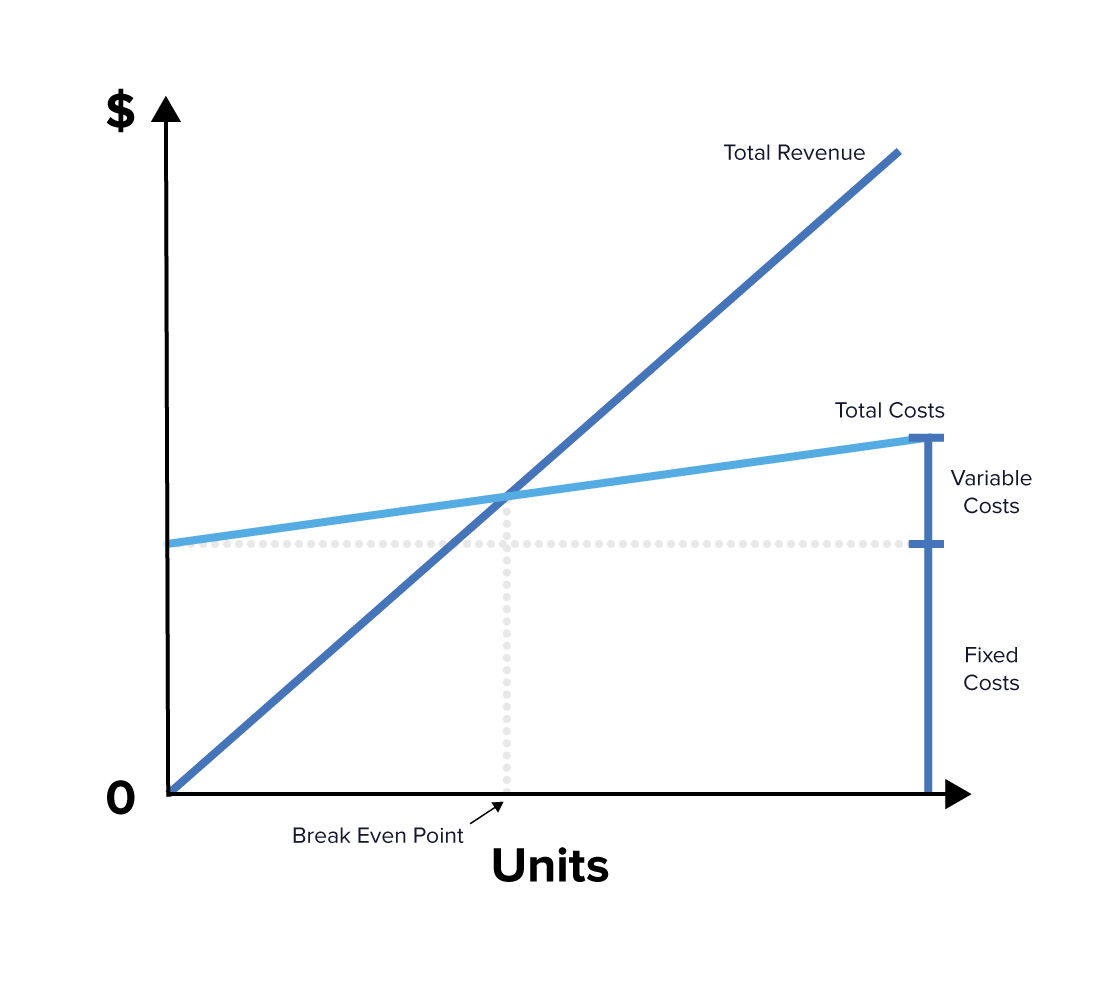

Break-even analysis looks to be a very valuable and useful aid to decision making. In the break-even charts the concepts like total fixed cost total variable cost and the total cost and total revenue are shown separately. In the break-even analysis we keep everything constant.

The following points highlight the top ten managerial uses of break-even analysis. Iii It helps in forecasting costs and profit as a result of change in volume. Despite of its limitations break even analysis is a useful technique for managers in the following cases.

Once these numbers are determined it is fairly easy to calculate break-even point in units or sales value. A break-even analysis is an economic tool that is used to determine the cost structure of a company or the number of units that need to be sold to cover the cost. 3 Equipment selection and replacement.

Decision on Choice of Technique of Production 6. Break even Chart is a graphical representation of marginal costing. Some important decision-making areas are as follows.

4 Pricing of the products. Break-even analysis is widely used to determine the number of units the business needs to sell in order to avoid losses. It has been defined as a chart which shows the profitability or otherwise of an undertaking at.

Break-even analysis therefore can be sound and useful only if the firm in question maintains a good. Ii It helps in the fixation of sales volume to cover a given return on capital employed. Profit when Revenue Total Variable cost Total.

The chart is very useful for forecasting costs and profits at various levels of production and sales. The selling price is assumed to be constant and the cost function is linear. Sales are unlikely to be the same as output there may be some build up of stocks or wasted output too.

Plant Expansion Decisions 8. The reason is that break-even chart shows the effect on profits of changes in fixed costs variable costs selling price and volume of sales. The break even chart shows the extent of profit or loss to the firm at different levels of activity.

These limitations are as follows. This point is called the breakeven point. Break-even analysis is a useful tool for working out the minimum sales needed to avoid losses.

I It helps in the determination of selling price which will give the desired profits. We may now mention some important limitations which ought to be kept in mind while using break-even analysis. Certainly break-even charts are relatively easy to construct and provide managers with information on break-even forecasts margins of safety and profit and loss at different output levels.

It is considered to be the most useful graphic representation of accounting data. The breakeven chart is a tool for short run analysis. The chart is highly useful for taking valuable decisions by the management.

1 To make a feasibility before starting a new business. 3 To measure profits or losses for the businesses for different output levels. The managerial uses are.

Limitations of Break-Even Chart. Break-even is a circumstance where a company neither makes a profit nor loss but recovers all the money spent. The total cost line representing the variable costs added to fixed costs need not be straight line in actual fact costs do not usually vary in direct proportion.

Therefore the concept of break even point is as follows. It cannot be used for 8 or 10 year projections because of the difficulty of indicating variables in each of the costs line on the chart. No doubt it is an important tool which helps to make profit planning.

It makes assumptions about various factors - for example that all. The constant cost concept is irrelevant since as the company increases its production volume economies of scale will lower the input cost. This calculation requires the business to determine selling price variable costs and fixed costs.

Therefore the break even point is often referred to as the no-profit or no-loss point The break even analysis is important to business owners and managers in determining how many units or revenues are needed to cover fixed and variable expenses of the business. Change in Costs 5. Limitations of break-even analysis.

All business firms need to know at what point their sales revenue or income will permit them to meet all their obligations fixed contractual and variable non-contractual. Meaning of Break-Even Chart. 2 To determine the selling price or the desired sales mix for earning target profits.

Unrealistic assumptions products are not sold at the same price at different levels of output. Change in Price 4. The Break-Even Chart is a graphical representation between cost volume and profits.

Fixed costs do vary when output changes. 1 illustrates the typical break-even chart. The objective of most private firms is to make profits or at least to avoid losses.

Significance of Break-Even Chart at Various Levels of Activity 3.

Break Even Analysis Decision Making Skills Training From Mindtools Com

No comments for "Describe Break Even Chart With Its Limitation and Specific Uses"

Post a Comment